BNP Paribas Real Estate, in partnership with LOCATUS, unveils its 2nd Pan-European footfall report, analysing the pedestrian traffic of the prime streets in 34 European key cities.

This report aims at providing a one-off overall and lifestyle “snapshot” of the prime streets in 34 key cities in Europe. Pedestrian traffic is one of the prime indicators to assess the strength of retail, albeit insufficient on its own to be a fully determinant driver. The fundamental measure of a successful retail area is the conversion of pedestrian flows into purchases. Indeed, in some areas of lesser footfall, such as for example luxury precincts, high store sales can be generated despite lower flows.

“BNP Paribas Real Estate is delighted to present the second edition of its Pan-European Footfall Analysis. The findings suggest that some level of normality has been restored to European downtown prime pitches: brick-and-mortar premises still have traction, city centres are proving their appeal, along with some new retail models and formats that are being successfully introduced to inner cities”, declares Patrick Delcol, Head of Pan European Retail at BNP Paribas Real Estate.

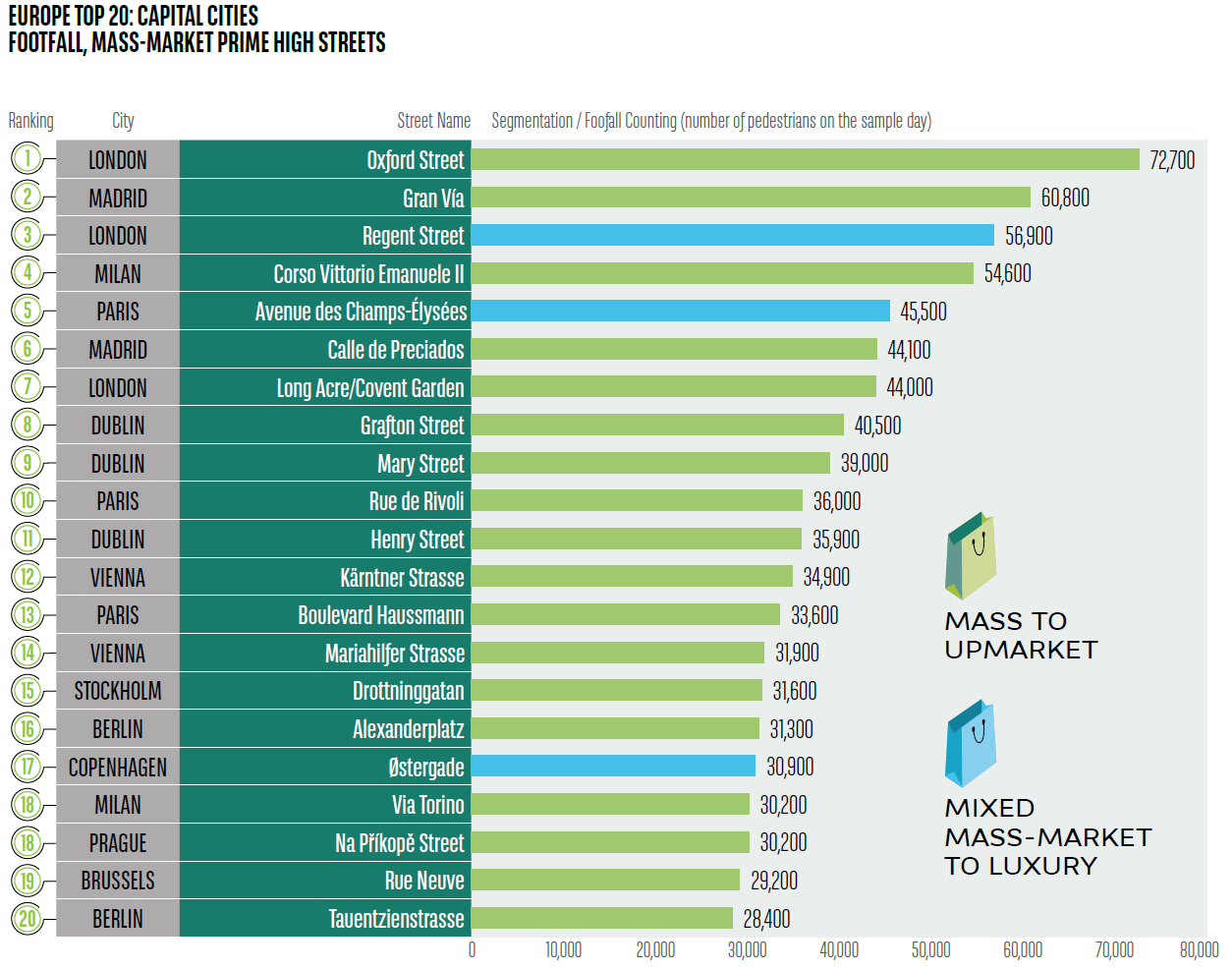

FOOTFALL TOP 20 MASS-MARKET PRIME HIGH STREETS: CAPITAL CITIES

The United Kingdom, Spain, Italy and France are home to the Top 5 streets in European capital cities.

As in the first edition of our footfall report (2017), Oxford Street in London is still in pole position in Europe, followed by Regent Street, which has narrowed the gap with the frontrunner.

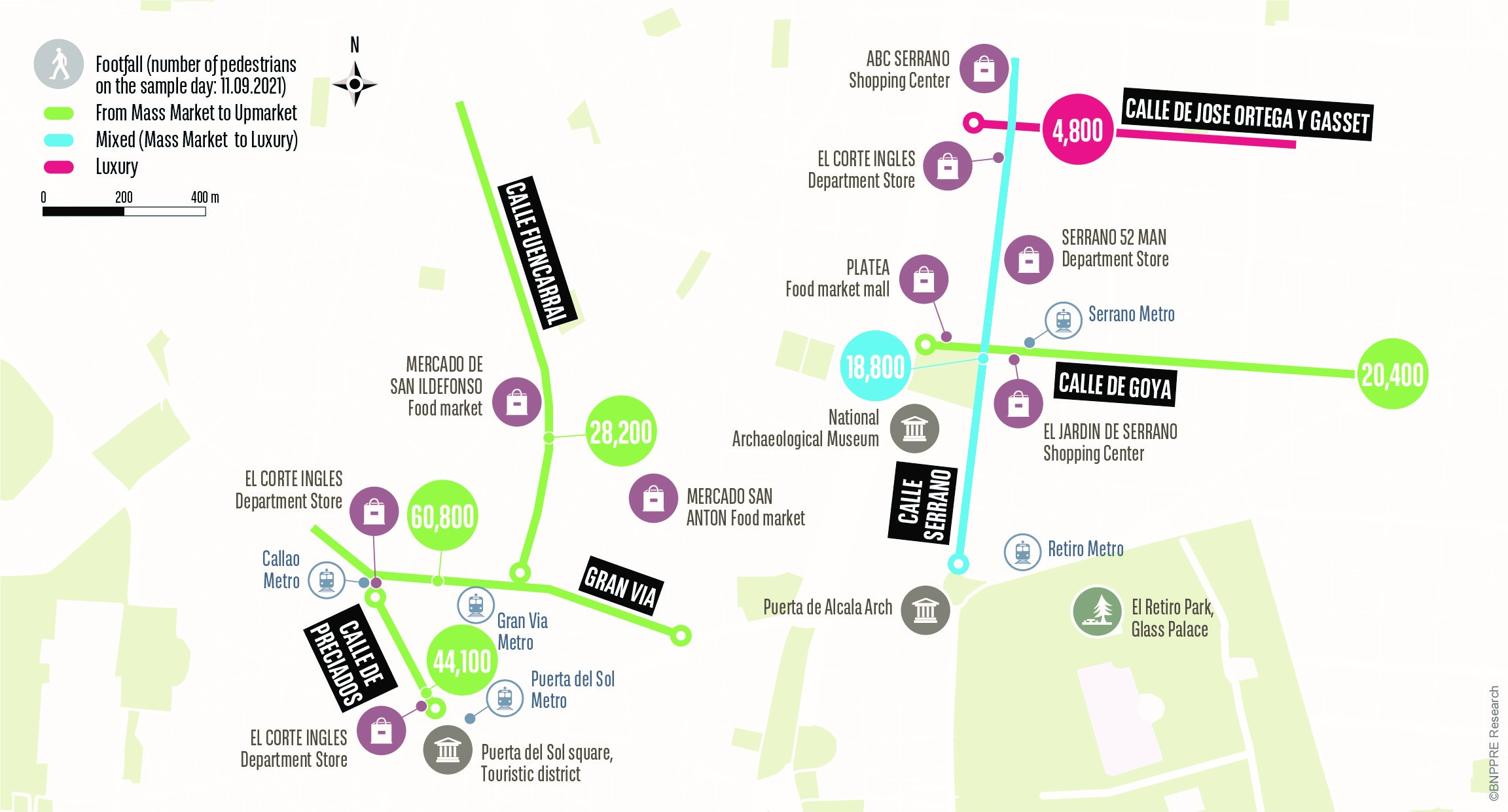

Madrid takes second place among European capitals thanks to Gran Vía with a daily footfall of 60,800 on the counting day, followed by Calle de Preciados (6th place).

Milan is proving to be resilient and ranks high in Europe with Corso Vittorio Emanuele II.

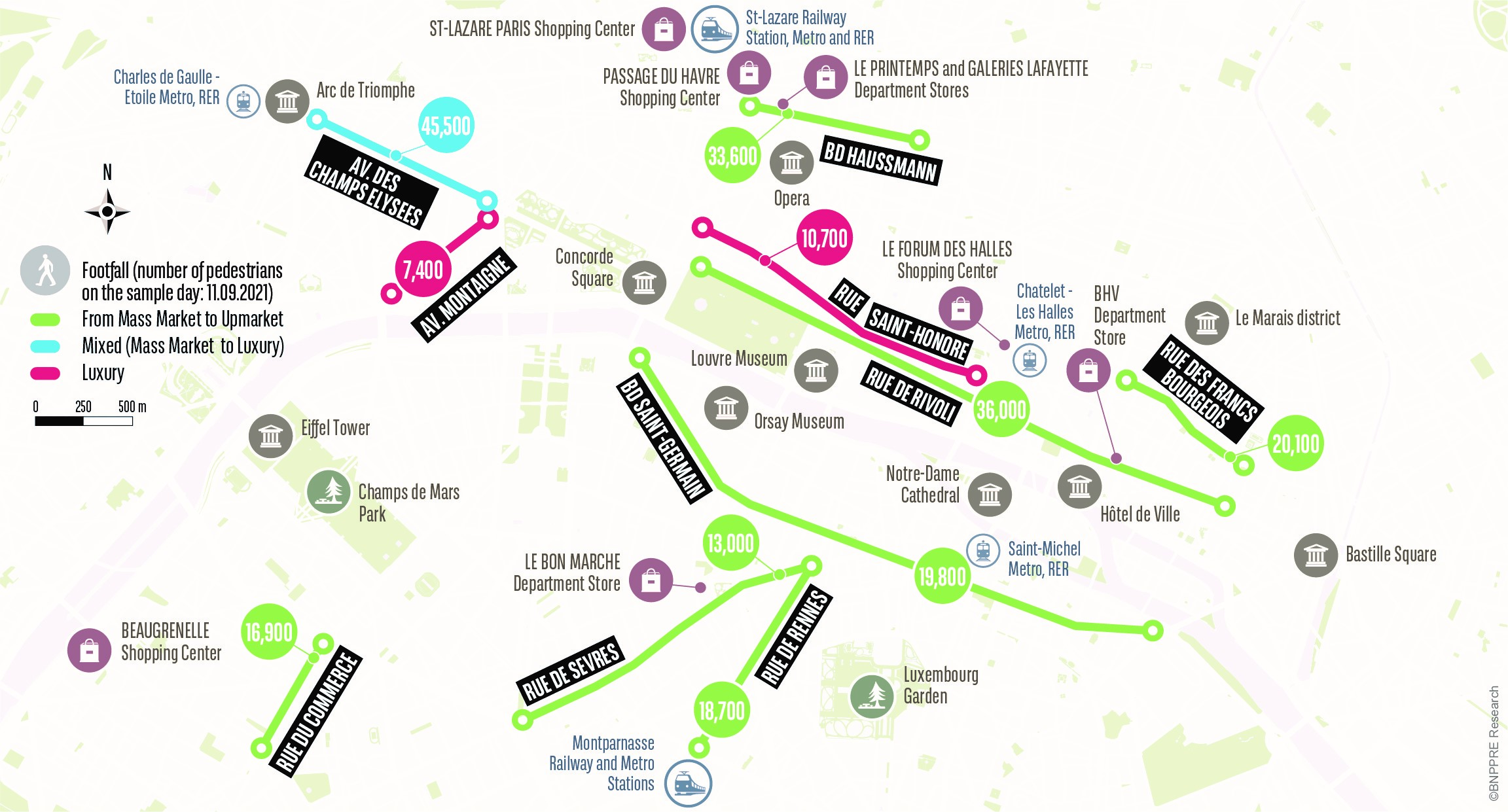

Paris has three streets in the Top 20, with the Champs-Elysées still leading, while Rue de Rivoli also ranks highly (10th place, footfall of 36,000), followed by Boulevard Haussmann (13th place).

Source: BNPPRE/Locatus

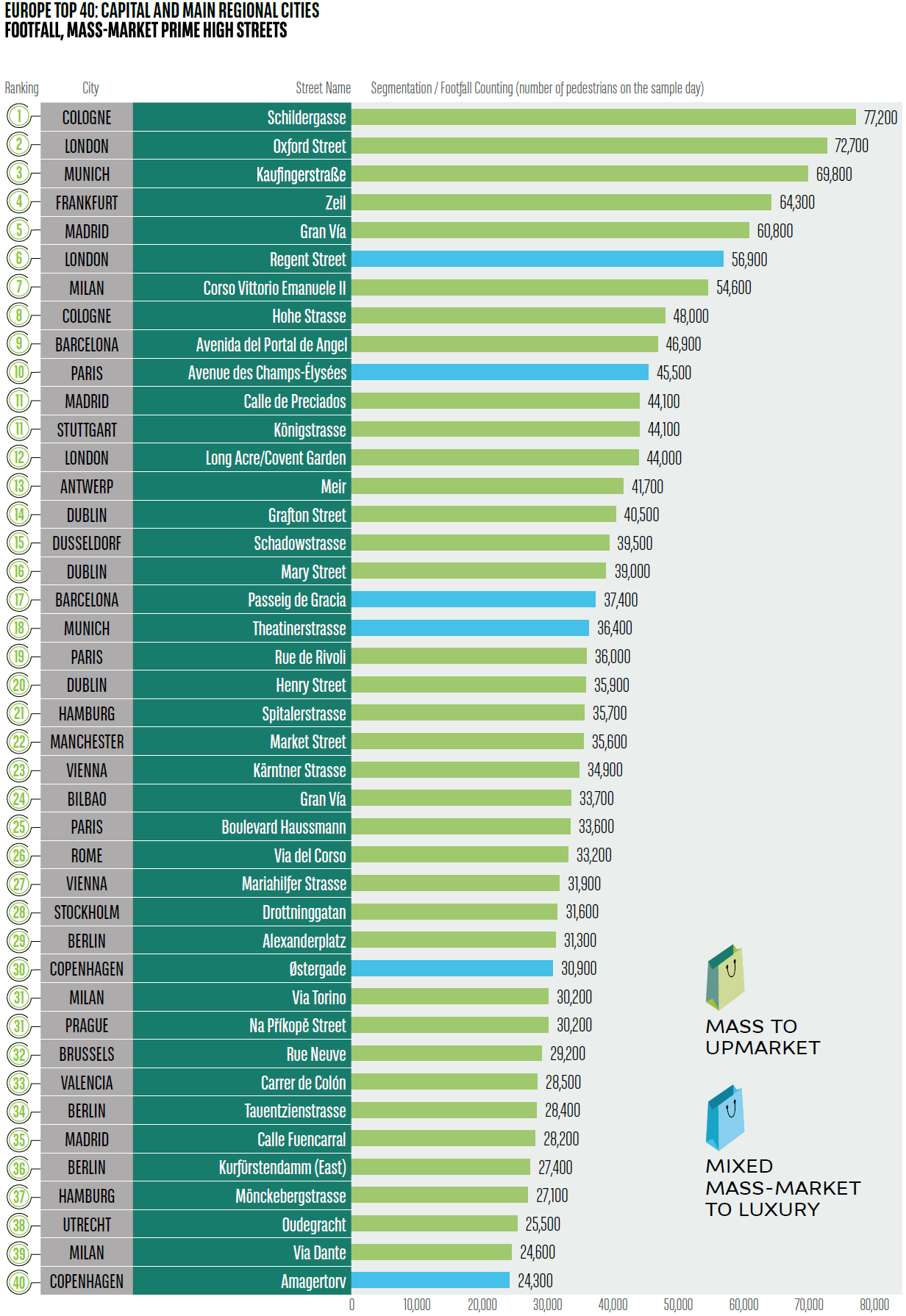

FOOTFALL TOP 40 MASS-MARKET PRIME HIGH STREETS: CAPITAL AND MAIN REGIONAL CITIES

As regards the Top 40 prime streets out of the 34 major European cities, German city centres score highly for their pedestrian flows, with Cologne, Munich and Frankfurt all highly ranked

Source: BNPPRE/Locatus

Barcelona is traditionally a very touristic city and is still in the top 10 European streets, losing ground to Madrid compared to 2017. Similarly, Rome is seeing a gradual recovery in tourism.

In Belgium, the Meir in Antwerp is still in top place for footfall, followed by Rue Neuve in Brussels.

Two cities stand out for their major regional appeal, Manchester and Bilbao both rank highly (22nd and 24th).

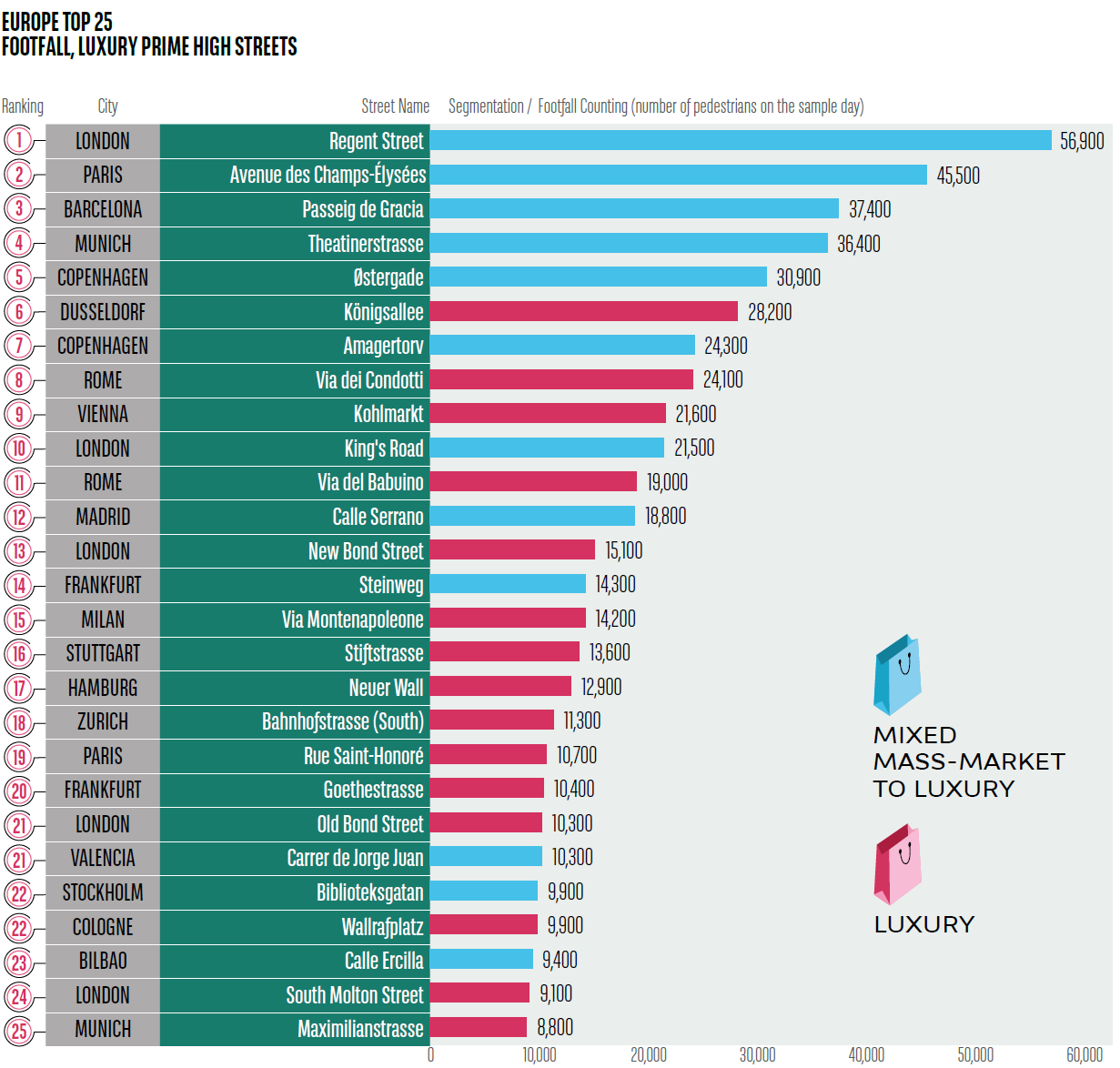

FOOTFALL TOP 25 LUXURY PRIME HIGH STREETS

The Top 3 luxury streets are unchanged compared to our 2017 edition with three iconic areas in the lead: London, Paris and Barcelona

Source: BNPPRE/Locatus

In fourth place is Munich, with the Theatinerstrasse, which has become more exclusive over the past 4 years. Similarly, the mixed streets of Copenhagen have confirmed the quality of their positioning and rank top among the prime Nordic thoroughfares.

The purely luxury streets are dominated by Dusseldorf, Rome and Vienna.

TRENDS AND PROSPECTIVES

In addition to the footfall analysis of "prime" shopping streets, the report has highlighted similar trends across Europe concerning the development of downtowns and cities’ urban policy.

Widespread emergence of mixed-use projects in city centres

Mixed-use projects are becoming the norm throughout Europe. Local authorities support these urban developments as they strive to upgrade their inner cities and breathe life back into neglected districts. These schemes are popular as they attract different categories of people - shoppers, workers and inhabitants - which generate constant flows. Investors and developers are paying more and more attention to these assets, which enhance downtown plots, restore financial equilibriums and meet citizens’ growing demand for greener spaces.

These redevelopments include offices, residential units, restaurants, stores, hotels as well as green and recreational spaces to form a complete ecosystem, attracting local and foreign shoppers and visitors who are happy to diversify their city centre experience.

Cities promoting urban mobility to make downtown access easier

With current national policies focusing on climate and sustainability, and seeking to improve the living conditions of European city dwellers, numerous transport-upgrade projects are underway throughout Europe. In order to retain their appeal to a population that can now choose whether or not to frequent CBDs thanks to remote working, cities are proactively making their suburban transport routes shorter: from Milan to Stockholm, and from Lisbon to Barcelona, European cities, often historically organised around cars, are now turning to new mobility systems.

As large cities are often perceived to be noise and air polluters, these upgrades help to burnish their green credentials, in addition to providing efficient new multimodal facilities. In turn, new mobility patterns enlarge retail catchment areas by bringing potential fresh clienteles to downtown shops. Bicycle paths, already in vogue, are now at the heart of the city's transportation network.

Lastly, for some cities like Brussels and Vienna, these mobility policies include new car-free retail circuits, by dedicating even more streets to pedestrians and improving their shopping experience.

Reestablishing importance of physical events along with new digital experience

European city centres must overcome numerous challenges to restore pedestrian traffic, including remote working and the slow recovery of international tourism. Many cities like London, Budapest, Milan or Paris are multiplying the number of events they hold, offering an unparalleled experience. Some are turning to world sporting competitions (such as the Olympics) to boost their infrastructures and promote their lifestyle, but they are all also offering more regular activities such as music festivals, seasonal events or special theme days. With these physical events, cities are taking advantage of the limits of digital experience – which cannot replace physical gatherings - and generating traffic by revitalising neighbourhoods.

METHODOLOGY

The analysis has been supported by BNPPRE Research teams, Retail Agencies and Alliance partners across 19 European countries, in partnership with LOCATUS for the supply of footfall and retail street data. Counting was conducted by LOCATUS in 130 prime streets of 34 main cities all over Europe during one Saturday per city chosen within 3 dates, the 4th, 11th and 18th of September 2021. Each city was divided into “Mass-Market to Upmarket” and “Luxury” categories and between 2 and 10 streets were selected, depending on scale and population of the city.

34 studied cities: Amsterdam · Antwerp · Athens · Barcelona · Berlin · Bilbao · Brussels · Budapest · Cologne · Copenhagen · Dublin · Dusseldorf · Frankfurt · Geneva · Hamburg · Helsinki · Lisbon · London · Madrid · Manchester · Milan · Munich · Oslo · Paris · Prague · Rome · Rotterdam · Stockholm · Stuttgart · Utrecht · Valencia · Vienna · Warsaw · Zurich

To download the complete report, click HERE

ANNEX: FOCUS ON 5 EUROPEAN CITIES

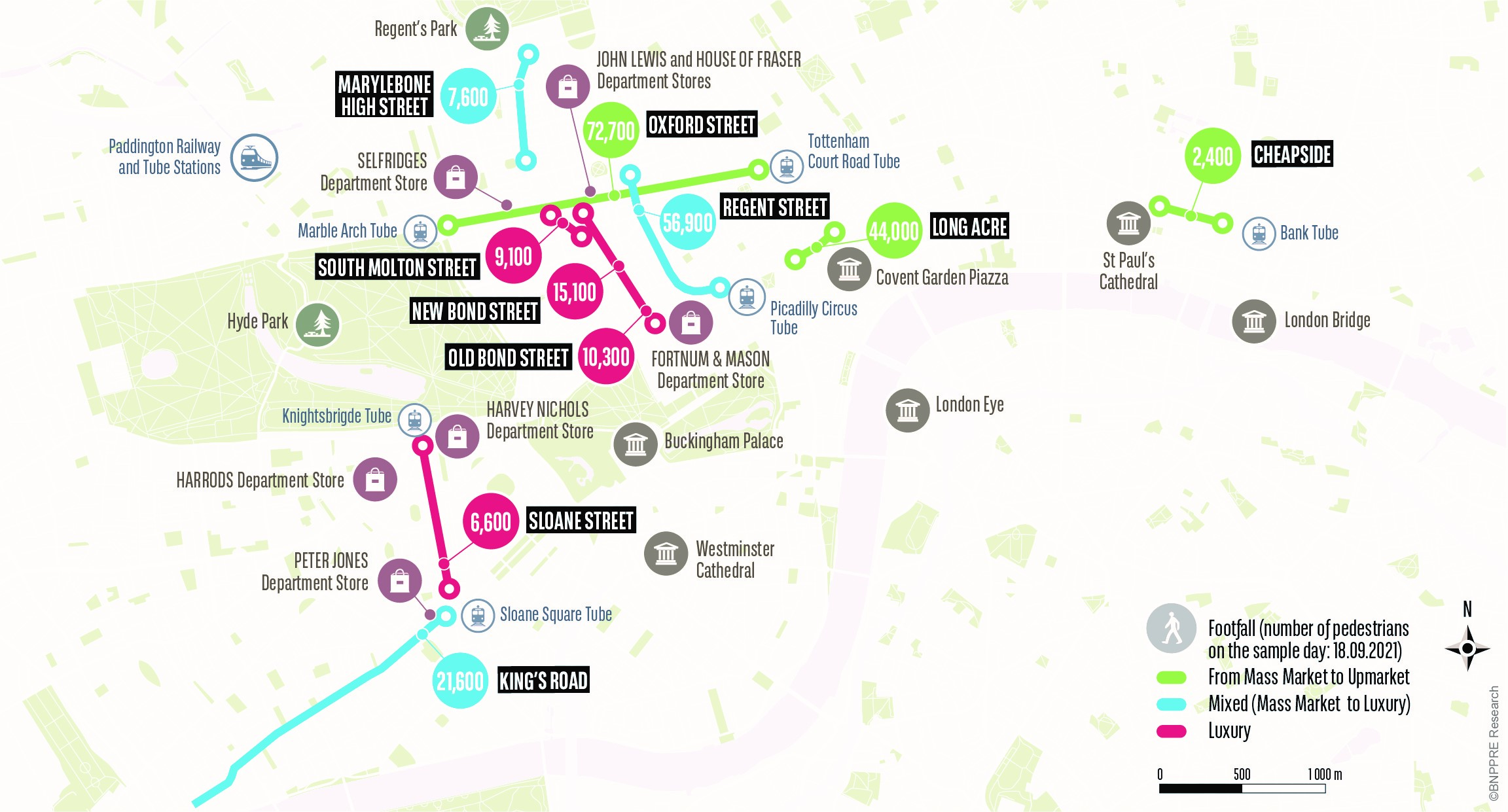

LONDON

Oxford Street has traditionally benefited from sustained footfall from white-collar workers and tourists alike. The structural issues that retail has faced are visible on Oxford Street. The strategic revitalisation of the area will be crucial to its long-term success. Schemes like the new Oxford Street District Plan are incorporating pedestrianisation, investment in public facilities and sustainability to enhance the street’s appeal.

Regent Street continues to attract international retailers seeking flagship stores. The Crown Estate’s placemaking of the street also draws consumers, and traffic free events (Summer Streets, NFL) have ensured variety in the retailing experience. Longchamp and Church’s are some of Regent Street’s most recent occupiers.

Bond Street remains the global luxury street in London. It attracts significant interest from wealthy foreign visitors and demand for luxury goods from this spending cohort is still strong. Record-high rental premiums still make Bond Street the most expensive retail street in the UK.

PARIS

The 1.9km Avenue des Champs-Elysées remains an iconic address, home to major retail flagships as well as exclusive venues. It also includes cinemas, restaurants, fashion stores, prestigious car showrooms (Mercedes, Renault) and anchors (Apple, Samsung, Galeries Lafayette).

Nike opened its new flagship "House of Innovation" at no. 79 in 2020, also called “The Parisian temple of sport”, with over 4,300 sqm, while Rolex has opened a new store at no. 71. Latest arrivals include the eagerly awaited Carven Image store, and further changes are afoot with, for example, the redevelopment of Galeries Basses.

Near the Champs-Elysees, Avenue Montaigne is the premier address for luxury in Paris and worldwide attracting very high-profile clients. Prestigious stores include Armani, Dior, Chanel, Louis Vuitton and Saint Laurent. In spring 2021, the brand Dolce & Gabbana opened the largest luxury flagship of the avenue. Rue Saint-Honoré is the 2nd most sought-after place for upscale and luxury brands, especially in its western section.

Rue de Rivoli made the headlines with the reopening of the prestigious La Samaritaine in 2021, closed for 16 years. The street stands out for its varied offering including the newly opened Ikea and Uniqlo (2,000 sqm).

Boulevard Haussmann is world famous for its iconic department stores, Galeries Lafayette and Printemps, complemented by a mass-market offer (H&M, Zara, C&A, Uniqlo).

MADRID

The Centre district has a mass-market offering (90% of the stores) stretched over five streets, and is home to most of Madrid’s high street retailers, with over 500 stores. Gran Vía has strengthened its role as a key destination thanks to powerful flagship stores like Primark, Adidas and Huawei. It is also a popular leisure and tourist area day and night, mixing cinemas, theatres and restaurants in addition to its comprehensive fashion offer. The renovated Plaza de España will galvanize local retailers by generating footfall in a pedestrian green area.

In Salamanca district, Serrano stands out as a key business and retail avenue. The retail spectrum is large, with luxury representing 20% of the offer within a perimeter defined by Calles Alcalá and Goya/Hermosilla, and Calle Don Ramón de la Cruz to Calle José Ortega y Gasset. Building on its genuinely exclusive positioning, the elegant José Ortega y Gasset Street has proved a select address for high-wealth regular clients, resulting in lighter but focused traffic.

MILAN

Corso Vittorio Emanuele II is a prime mass-market retail destination in Italy and Europe. It benefits from a high level of footfall anchored by one of Europe's major department stores, La Rinascente, and a high number of renowned fashion retailers such as Zara, H&M and Foot Locker. The street has a very limited vacancy rate and strong demand for quality space.

Via Montenapoleone is a core destination for luxury and premium brands. Its quality retail generates a limited vacancy and rapid re-lettings. The street is home to numerous iconic fashion brands such as Gucci, Valentino, Rolex, Bulgari, Prada and Hermès; it attracts flows of both tourists and local high-wealth regular customers with its unique offer as well as fashion and design events. Future arrivals include Harry Winston in 2022.

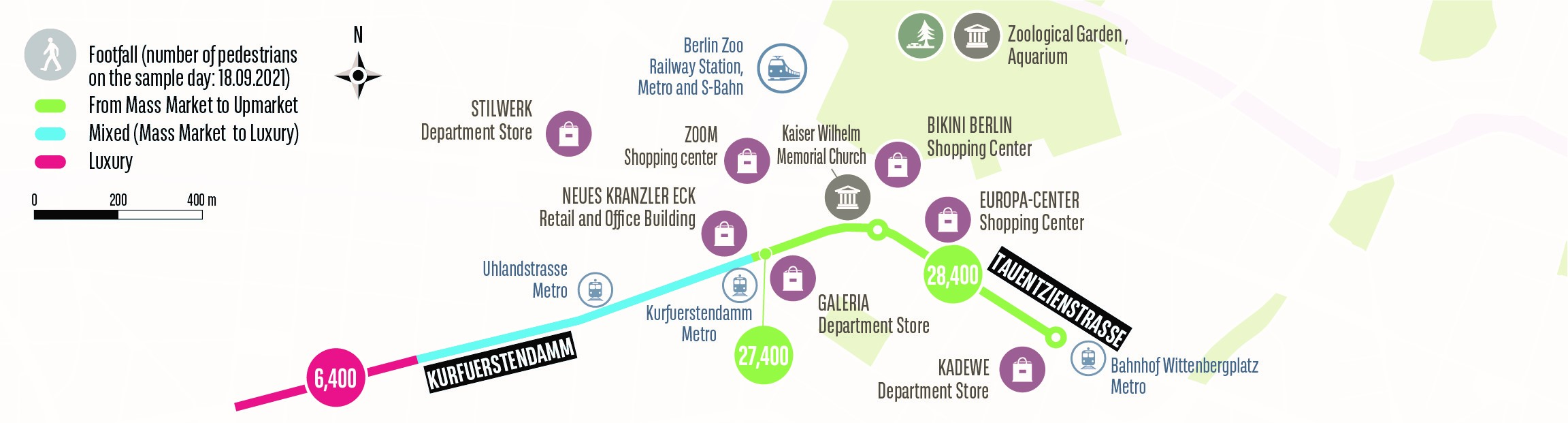

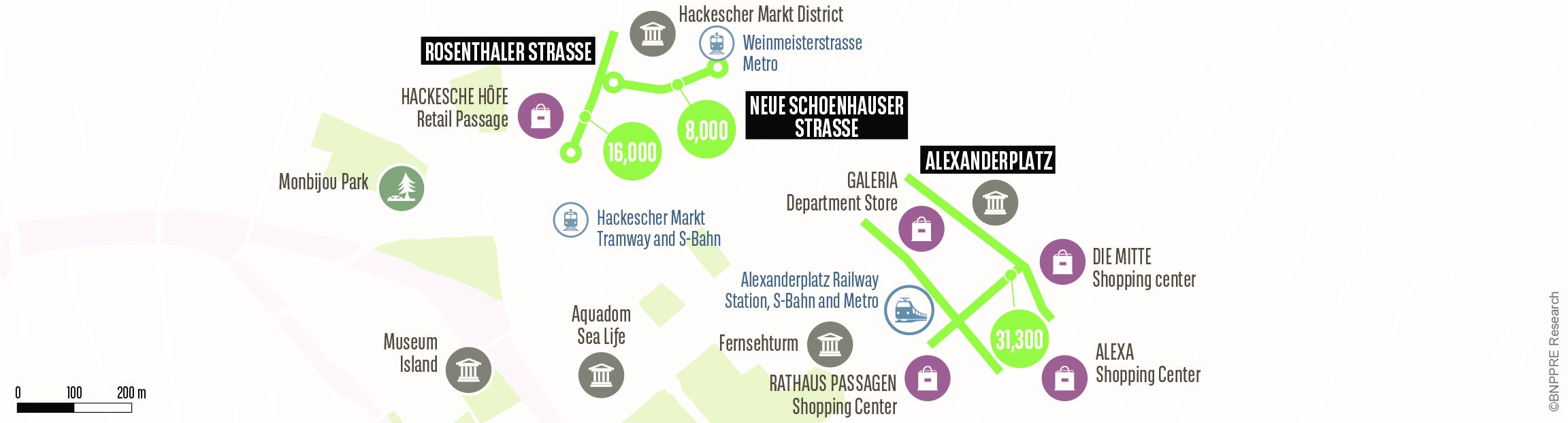

BERLIN

The 3.5-kilometre-long Kurfürstendamm, together with Tauentzienstrasse adjoining it to the east, form the hotspots of City-West and represent one of the most important German stages for national and international retailers, such as Nike, H&M or Zara. The numerous mixed-use projects such as FÜRST or Gloria Galerie reflect the convergence of various urban functions in this very busy location. The western section of the Ku’damm in particular is home to numerous luxury brands such as Bulgari, Gucci, Moncler, Philipp Plein, Salvatore Ferragamo, Versace and Zadig&Voltaire, among others.

The versatility of Berlin's retail landscape is particularly evident in the Hackescher Markt submarket, where Münzstrasse, Neue Schönhauser Strasse and Rosenthaler Strasse are among the most important shopping streets. Alexanderplatz is not only a highly frequented public transport hub and sightseeing hotspot, but also a very important retail submarket thanks to its extremely high density of large-scale retailer.

- Amira TAHIROVIC