- Retail investment has picked up, with H1 2022 figures the highest in three years. Footfall improved in every European city, and many retailers reported an increase in turnover.

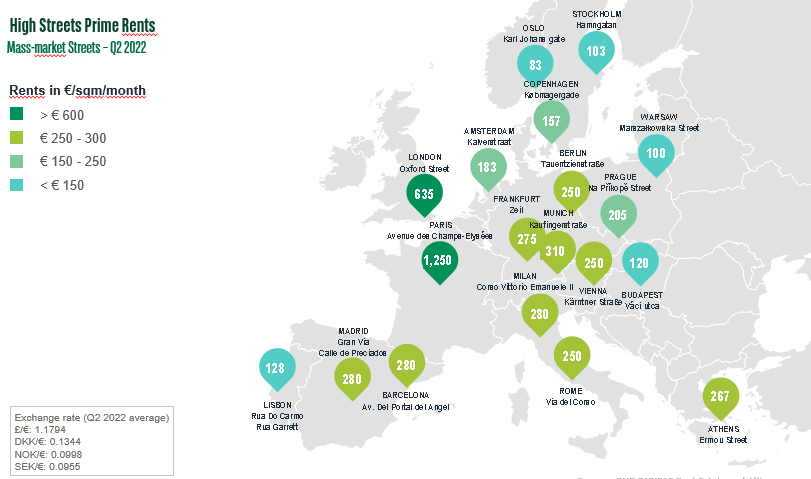

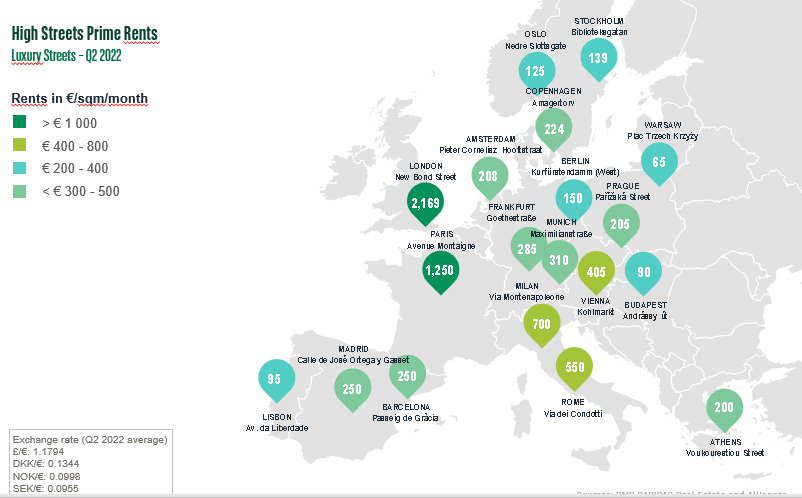

- Prime rents were stable in most markets. Rents in luxury streets are on the rise again while the general trend for mass-market streets is still downward for now, but rental growth could resume in some key European markets in the coming years.

Retail investment continues to rebound

Retail investment increased significantly in H1 2022 (+23% y.o.y), totalling €19.7bn. Over the past 12 months, European retail investment has risen by 19% to €43.2bn.

German retail investment increased in H1 2022 compared to H1 2021, thanks to higher retail warehouse transaction volumes, although still below the 5-year average.

Retail investment in the United Kingdom was strong in Q1 2022 but slowed in Q2, resulting in an H1 figure below the historical average.

After a record first quarter, French retail momentum continued with €2.5bn invested in H1. More than 100 transactions were closed in H1 2022 compared to less than 70 in H1 2021, and among these, six exceeded €100m.

Spain exceeded its H1 average with €2.8bn, notably driven by BBVA's acquisition from Merlin Properties of over 600 bank branches for almost €2bn.

Sources: BNP Paribas Real Estate and Alliances

Retail warehouse assets* are still flourishing. In the 6 main European markets**, investment in retail warehouses (€15.2bn) has risen by a record +24% over the past 12 months. “Their accessibility and value-for-money brands, as well as their ability to operate as hybrid last-mile delivery hubs, have kept them attractive to both customers and investors.” comments Patrick Delcol, Head of European Retail at BNP Paribas Real Estate.

Retail prime yields are steady

After yield decompression in 2020, most high street markets in Europe stabilised over 2021 and into 2022. The exception is London, which saw compression in its prime high street yield of 25 bps compared to 2021.

Yield change for prime shopping centres was minimal in Q2, except in Spain where they narrowed by 20 bps.

Retail park prime yields showed some compression in 2021 and 2022, as their flexibility in times of uncertainty and the potential to reposition themselves as warehouses have lured retail investors.

Occupier markets are recovering while tourists are returning

Many retailers reported an increase in turnover, with sales close to pre-pandemic levels. Luxury brands in particular performed strongly in H1. Mass-market and luxury companies experience inflation differently. Luxury benefits from stronger pricing power. Inflation can actually increase attractiveness by enhancing the sense of exclusivity that luxury thrives on.

The majority of cities experienced strong increases in footfall in H1 2022 compared to last year (+178% for the Schildergasse in Cologne, +82% for Oxford Street in London, +68% for Avenida del Portal del Angel Barcelona) even though 2019 levels have not yet been reached. Overall, from January to May 2022, Europe welcomed four times more international tourists (+350%) than in the first 5 months of 2021, according to the UN World Tourism Organization.

Slight downward adjustments in rents were recorded in H1 for most mass-market streets. Oxford Street in London, Avenue des Champs-Elysées in Paris and Kalverstraat in Amsterdam experienced downward pressure on their rental values. In Germany, overall prime rents have stabilized at a lower level than before the COVID-19 crisis. Na Příkopě Street in Prague however recorded a 14% increase of its rental value in Q2 2022 compared to Q2 2021.

Sources: BNP Paribas Real Estate and Alliances

Recent sales figures from luxury brands (Hermès, LVMH, etc.) underline the capacity of these high-profile streets to recover quickly from events like pandemics both in footfall and sales. Moreover, unlike many industries, the inflationary environment has less impact on luxury, as the customer base is mostly high income or high net worth consumers.

This resilience may have led to an increase in rental values in several European cities. Avenue Montaigne in Paris, Kurfürstendamm (West) in Berlin, Via Napoleone in Milan or Pařížská Street in Prague have seen their rents growing compared to Q1 2022. For Paris in particular, prime rents on the luxury Avenue Montaigne now match those on Avenue des Champs-Elysées (€1,250/sqm/month). The street benefits from the attractiveness of Dior, which acts as a magnet and draws other brands to it, pushing rents up. In Milan and Rome, with the easing of restrictions and tourism reaching pre-pandemic levels, prime rents in luxury precincts are increasing again in premium locations thanks to high demand from tenants and very little space available.

Sources: BNP Paribas Real Estate and Alliances

*Including retail parks, predominantly food stores, stand-alone units

**France, Germany, Italy, Spain, Poland, United Kingdom

- Amira TAHIROVIC